Our Insights.

We empower clients with tailored financial strategies in order to create brighter future for children worldwide.

SEPTEMBER 03, 2024

Fixed Income Quarterly Q3 2024: Sound fundamentals, stretched valuations

Disinflation appears to be back on track after setbacks earlier this year. Economic and corporate fundamentals are sound, but valuations seem stretched.

The Goldman Sachs Fixed Income Quarterly Outlook for Q3 2024 highlights the current state of the fixed income market, with strong economic fundamentals and robust corporate health. However, political uncertainty, stretched valuations, and inflation risks, particularly in services, are points of concern. Central banks are starting to ease monetary policies, but with varying approaches across regions. Consumer spending, while steady, shows early signs of strain among lower-income households, necessitating a cautious approach to fixed income investments.

Key Points:

- Disinflation appears to be back on track after setbacks earlier this year.

- Disinflation is progressing, but inflation risks remain, especially in services

- Economic and corporate fundamentals are sound, but valuations are stretched.

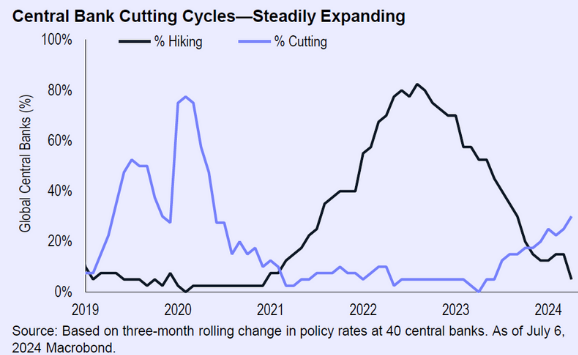

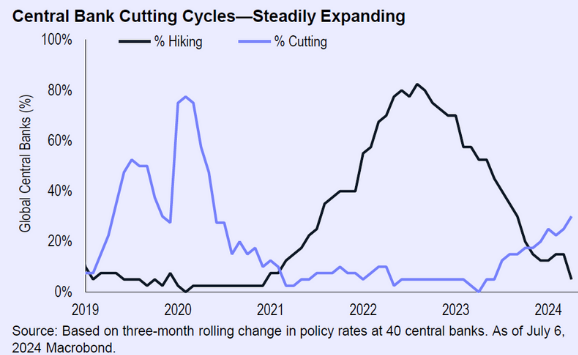

- Major central banks are either easing or soon to begin cutting rates, setting the stage for a supportive environment for fixed-income assets.

- The coming months will likely reinforce the importance of diversification to mitigate risks.

Our Vantage Point

At Vantage Capital, we align our views with Goldman’s assessment that disinflation is progressing and growth remains resilient, particularly in the US. Our models also anticipate the first rate cut in September, which should bolster economic growth. In this environment, our forward-looking strategy emphasizes a selective approach, focusing on generating attractive income in a higher yield setting. We also aim to capture risk premiums to enhance total returns. While we lean into bonds, we remain selective and advocate for including alternative assets to bolster portfolio resilience.