Our Insights.

We empower clients with tailored financial strategies in order to create brighter future for children worldwide.

SEPTEMBER 08, 2024

Is the Fed behind the curve?

Chair Powell clearly signaled a dovish pivot at Jackson Hole, but has the Fed has waited too long to cut rates amid this more worrying macro backdrop?

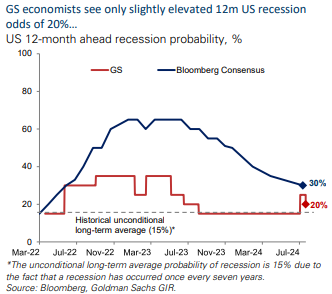

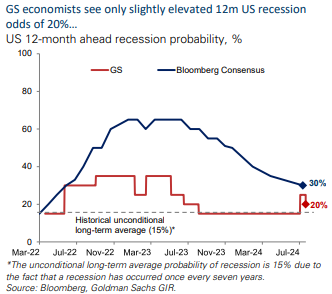

This report from Goldman Sachs explores whether the Fed is behind the curve, particularly after the July US employment report triggered the Sahm rule, a reliable recession indicator. Economists are split on recession risks, with some suggesting that the rise in unemployment is due to an increase in labor supply rather than a weakening in demand (a view we agree with at Vantage Capital). While some experts argue that the Fed may already be too late to prevent a recession, others remain optimistic about the strength of the labor market and consumer spending. Market strategists suggest that risky assets have room to run unless a sharp recession occurs. Despite concerns, GS sees the likelihood of a recession at 20% (see the picture below).

Key Points:

- The July US employment report triggered the Sahm rule, a recession indicator that has accurately predicted all US recessions since 1970.

- Markets are not pricing in a recession, leaving risky assets vulnerable if one occurs.

- Economic and corporate fundamentals are sound, but valuations are stretched.

- US equities have room to rise, according to GS analysts, unless a sharp recession hits.

Our Vantage Point

At Vantage Capital, we see the probability of a recession as moderate, and our models suggest a 25% probability of a recession within the next year. We think the Fed’s shift toward rate cuts, starting in September, will provide much-needed relief to the economy, especially for the consumer sector, which remains resilient. Yet, we urge caution and suggest maintaining a balanced portfolio that includes defensive strategies, high-quality equities, and alternative assets.

About Vantage Weekly

Vantage Weekly is your trusted source for carefully selected research and insights. Each week, our team of analysts curates the most relevant reports and analyses to help you navigate the ever-changing financial landscape with confidence.

Published on September 1, 2024

Spotlight on Policy Uncertainty and Global Disinflation: Strategic Insights for the Modern

Read more

Published on September 3, 2024