Our Insights.

We empower clients with tailored financial strategies in order to create brighter future for children worldwide.

OCTOBER 07, 2024

The Agony and The Ecstasy

This week, we review J.P. Morgan’s latest analysis on concentrated stock positions, focusing on the risks and potential rewards.

The report, titled “The Agony and the Ecstasy 2024,” explores the reality that even well-managed companies, profitable at their peaks, can experience catastrophic declines due to various risks.

The question for investors is: How can one mitigate this?

Key Points:

- Event risk: Many companies have experienced catastrophic declines of over 70%, underscoring the unpredictability of market risks.

- Macroeconomic impact: Factors like inflation and rate hikes can exacerbate stock declines, particularly for leveraged companies.

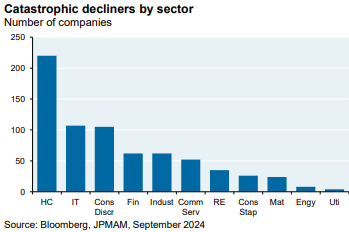

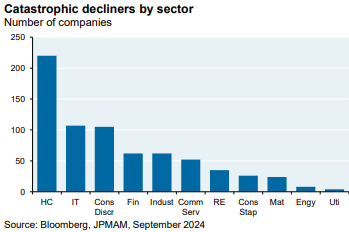

- Sector risks: Healthcare and biotech sectors saw the largest number of steep declines, despite previously strong performance.

Our Vantage Point

At Vantage Capital, we emphasize the importance of diversification in portfolios to hedge against event risks tied to concentrated positions. While concentration can provide outsized gains, it can also lead to extreme losses, as seen in the examples highlighted in J.P. Morgan’s report. By integrating risk management tools, such as hedging and strategic diversification, we help our clients navigate these risks more effectively.

If you’d like more information on how we manage reinvestment risk for our clients or to discuss your investment strategy, we’d love to hear from you.