Research Hub.

OCTOBER 20, 2024

Diversify to Amplify

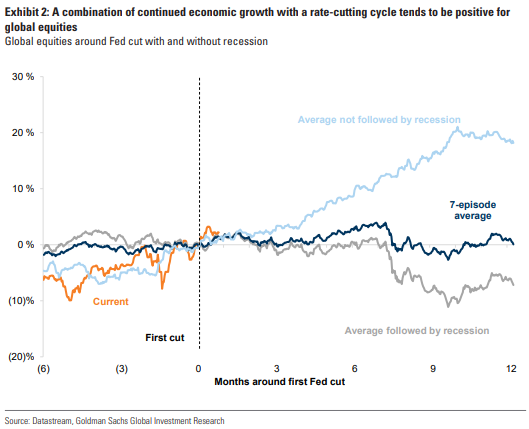

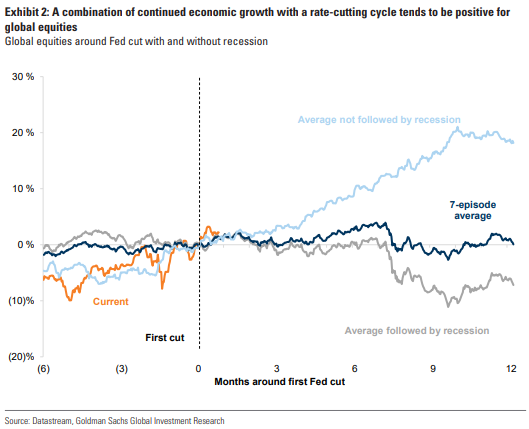

In this week’s Vantage Point, we review Goldman Sachs’ latest global strategy report. As interest rates begin to decline globally, the report emphasizes the importance of regional diversification to maximize risk-adjusted returns. This is particularly relevant in an environment where US equity valuations remain high, and other markets offer relative value.

Key Points:

- Growth: Global growth remains steady as central banks embark on a rate-cutting cycle, signaling a positive environment for equities.

- Sector diversification: Investors are encouraged to diversify across sectors, especially in technology, healthcare, and real estate

- Regional opportunities: Goldman sees upside potential in China and Japan, as well as value in selective European stocks.

Our Vantage Point

At Vantage Capital, we agree with Goldman Sachs’ emphasis on diversification to enhance portfolio returns. While US equities have dominated in recent years, we believe opportunities also exist globally, particularly in undervalued sectors and regions like Europe and Asia. Given the uncertainty surrounding inflation and interest rates, we advocate maintaining a balanced portfolio, incorporating both growth and value strategies to benefit from different market cycles.

If you’d like more information on how we invest with our clients in the current environment or if you want to discuss your investment strategy, we’d love to hear from you.