Our Insights.

Curated research for global investors.

SEPTEMBER 22, 2024

Managing Reinvestment Risks

This week, we explore a critical topic in fixed-income investing: reinvestment risk.

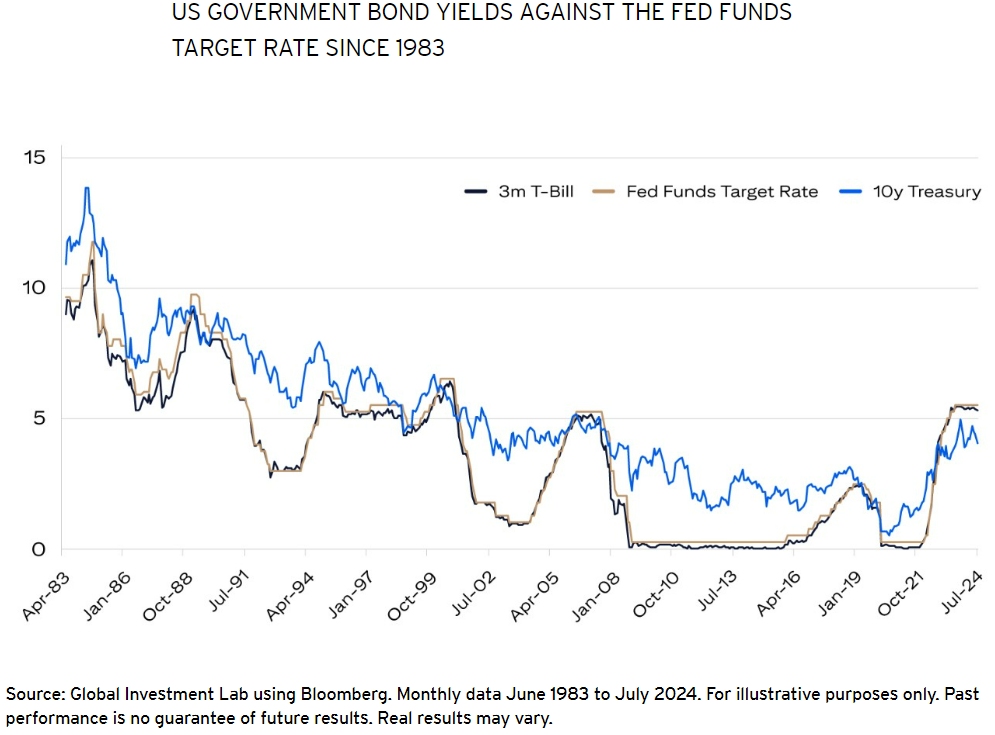

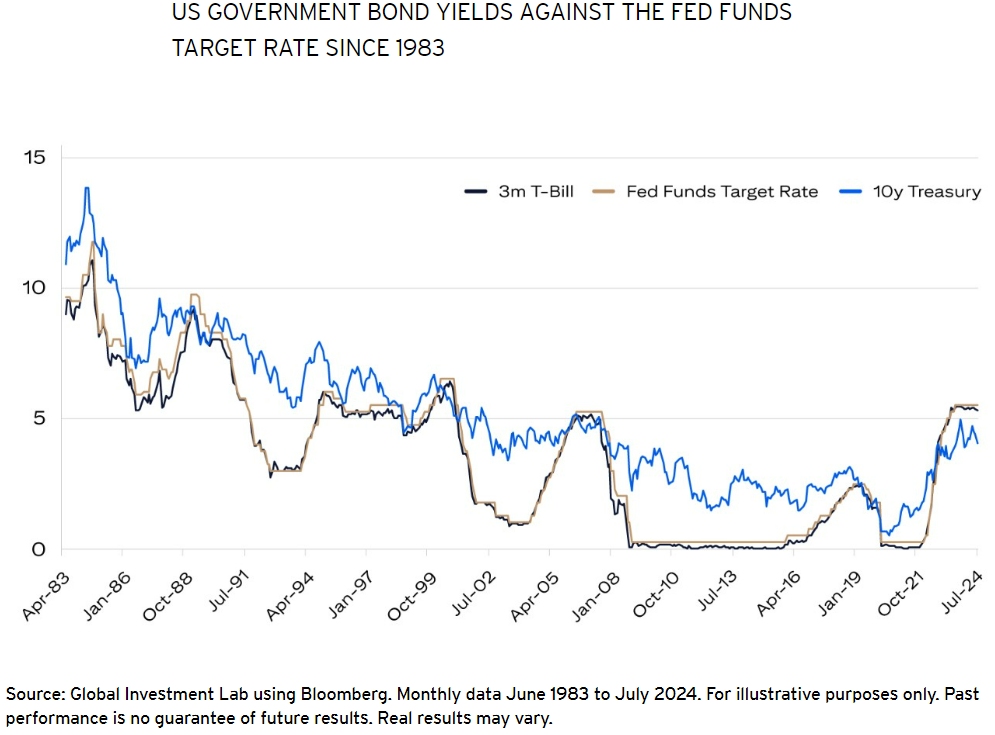

As interest rates have risen to the highest level seen in decades, many investors have found short-term yields attractive. However, after the Fed cut last week, we believe that managing the risk of reinvesting at lower rates has become essential to generating attractive risk-adjusted long-term returns. In this issue, Citi highlights the key strategies for tackling this issue.

As interest rates have risen to the highest level seen in decades, many investors have found short-term yields attractive. However, after the Fed cut last week, we believe that managing the risk of reinvesting at lower rates has become essential to generating attractive risk-adjusted long-term returns. In this issue, Citi highlights the key strategies for tackling this issue.

Key Points:

- Reinvestment risk occurs when the income from maturing bonds or coupon payments must be reinvested at lower rates, reducing overall returns.

- Short-term yields look attractive. Many investors may be tempted to lock in returns. However, some risk missing out on higher returns if rates decline in the future.

- Active management, diversification, and exposure to longer duration bonds are some of the strategies used to mitigate reinvestment risks.

Our Vantage Point

At Vantage, we understand that reinvestment risk is essential in the current interest rate environment. We believe that short-term yields are attractive, yet we encourage investors to take a longer view. We believe in diversifying across bond durations and leveraging active management to adjust portfolios based on evolving market conditions. This approach should secure more stable returns while mitigating the risk of reinvesting at lower yields in the future.

If you’d like more information on how we manage reinvestment risk for our clients or to discuss your investment strategy, we’d love to hear from you.