Research Hub.

OCTOBER 13, 2024

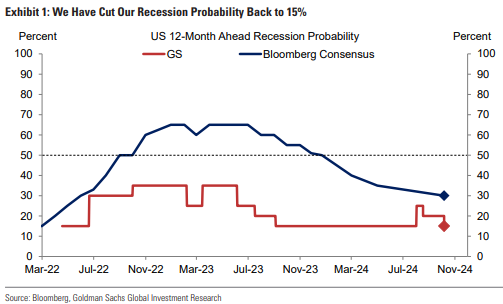

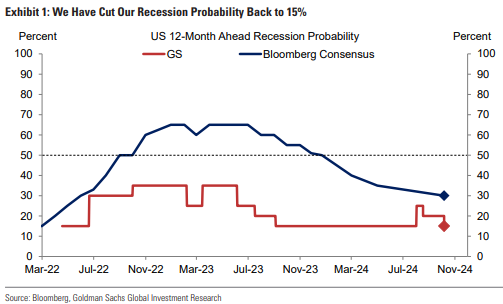

Recession probability back to 15%

This week, we review the latest report from Goldman Sachs, discussing the Fed’s new direction with rate cuts and its implications for investors.

The Fed surprised markets with a 50bp rate cut, shifting its focus from inflation control to employment concerns. This marks the beginning of a new rate-cutting cycle that Goldman expects to continue through 2025.

The rationale for the larger cut was driven by softening labor market data, with the Fed aiming to mitigate risks related to rising unemployment while maintaining a cautious stance on inflation.

Key Points:

- Fed’s shift: The Fed is prioritizing employment risks over inflation

- Gradual rate cuts expected: Goldman forecasts consecutive 25 bps cuts into 2025, with the terminal rate projected at 3.25-3.5%.

- Equity impact: Markets are expected to benefit, but Fed remains data-dependent, particularly on employment.

Our Vantage Point

At Vantage Capital, we see this new policy direction as an opportunity to position portfolios for yield in fixed income while maintaining flexibility in equities. The focus should remain on quality assets, as future rate cuts will depend on the labor market’s ability to stabilize.

If you’d like more information on how we invest with our clients in the current environment or if you want to discuss your investment strategy, we’d love to hear from you.